GOOD MORNING FROM LONDON

————————————–

#1 CHINA AND BHUTAN – INDIA LOOKS ON

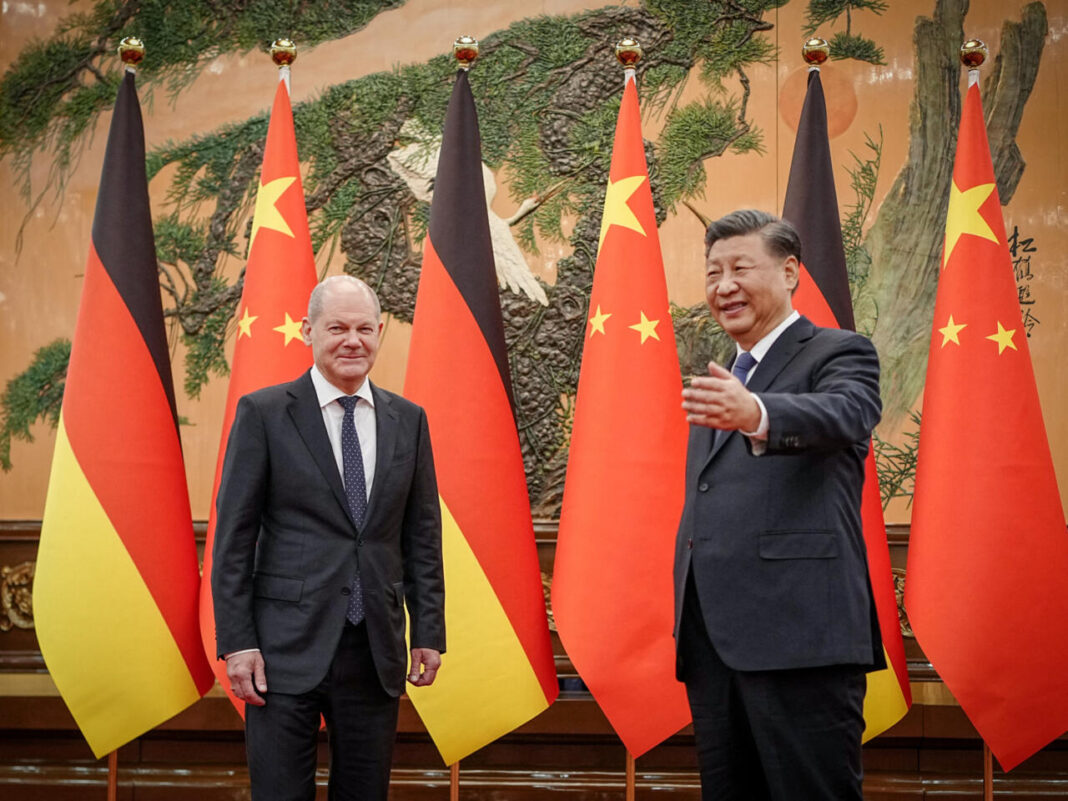

#2 GERMAN CHANCELLOR SHOLZ VISITS CHINA

#3 CHINA’S TROUBLED PROPERTY SECTOR

————————————–

#1 CHINA AND BHUTAN

NIKKEI ASIA

India’s Ministry of External Affairs described Modi’s [recent] visit to Bhutan as continuing a tradition of regular high-level exchanges between the two countries, and his government’s “Neighborhood First Policy” of developing friendly and mutually beneficial relations with surrounding nations.

Modi and Tobgay held talks over a working lunch, agreeing to further enhance cooperation in sectors such as renewable energy, agriculture, youth exchanges, the environment and tourism, an Indian government statement said. “India and Bhutan enjoy long-standing and exceptional ties characterized by utmost trust, goodwill, and mutual understanding at all levels,” it said. Modi also met with Bhutan’s King Jigme Khesar Namgyel Wangchuck.

Looming in the background is China. Beijing does not have diplomatic ties with Bhutan but has been stepping up efforts to establish them, amid ongoing talks to resolve boundary issues.

Sino-Bhutanese border talks formally started in 1984 but had been largely stalled since a 73-day military standoff in 2017 between India and China over the Doklam Plateau, where the boundaries of the two giants and Bhutan meet. China and Bhutan agreed in 2021 to expedite the negotiations, and if a settlement is reached, that could have strategic implications for New Delhi, which has its own long-running border dispute with Beijing.

According to Raj Kumar Sharma, a senior research fellow at NatStrat — an independent think tank working on India’s national security and foreign policy — Bhutan and India face similar Chinese pressure on their territorial sovereignty and integrity.

“China seeks to achieve a ‘package deal’ with Bhutan,” he told Nikkei Asia, noting that Beijing has been constantly pressuring Thimphu to concede territory in its west, where the Doklam Plateau is situated. In return, China could give up its claims in northern and eastern border areas with Bhutan.

Doklam is strategically significant for India due to its proximity to the Siliguri Corridor, a narrow strip of land known as the Chicken’s Neck, which connects northeastern Indian states with the rest of the country. Some experts feel any possible land swaps could raise worries for India about accessibility in a hypothetical conflict, while potential Chinese diplomatic representation in Bhutan could undermine New Delhi’s influence.

“Under its policy of ‘incremental erosion of buffers,’ China seeks to replicate its Nepal model in Bhutan as well,” Sharma said. “In Nepal, [it] has used all the levers of power to challenge India’s presence. It seeks to do the same in Bhutan as well.”

Late last year, China and Bhutan agreed on the responsibilities of a technical team that will work on border delimitation. A joint news release issued by the Chinese government said that “the discussions were held in a warm and friendly atmosphere.”

China’s economic presence is also gradually increasing in Bhutan, as it accounts for more than a quarter of Thimpu’s trade, Sharma said. Notable sectors with Chinese involvement include telecommunications, highways and hydropower.

Gandhi at the Vivekananda foundation observed that “economic stagnation and an unprecedented skilled labor exodus coupled with China’s charm offensive and simultaneous pressure presents a volatile environment for Bhutanese policymakers.”

However, she added that India, being the traditional security guarantor of the kingdom, “has been kept in the loop of all discussions” involving Bhutan and China. She also pointed out that India remains the principal development partner for Bhutan.

He noted that in India’s interim budget for the financial year starting next month, Bhutan has been allocated the biggest aid share in South Asia at 20.68 billion rupees ($248.8 million). Rail connectivity is being planned between the northeastern Indian state of Assam and the Bhutanese.

GRAHAM PERRY COMMENTS;-

China’s population is 1.4bn. Bhutan’s population is 0.754m (754,000). Bhutan is a landlocked country in South Asia located in the Eastern Himalayas between China in the North and India in the South. Bhutan has always operated very much within the orbit of India whose nationals administer the air control at the main airport in the capital Thimpu. But things are changing.

As has been seen in other parts of the world China is now a major player in international politics. In the post Cultural Revolution era and led by Deng Hsiaoping China focused on a policy of Reform which has had the effect of substantially boosting the size of China’s economy and its role on the world scene – the Belt and Road Initiative has witnessed China advancing USD1 trillion in loans to 130 countries to finance ports, railways, hospitals, airports and infrastructure in general.

Bhutan has not been overlooked – for two reasons. First, after a period off isolation and introspection, China has “come out”. Despite recent setbacks in its property sector, China remains focused on continuing to grow its economy which will within the next 5-10 years become the largest economy in the world. Bhutan features in China’s growth plans. Second, China is reaching out to the rest of the world and Bhutan, despite its relatively small population, is a sovereign country and along with thirteen other sovereign countries shares a border with China.

This Column has not recoiled from returning to this main theme – the consequence to the world at large of a resurgent China. It remains the dominant long term international issue of significance with consequences for the structure of world development and the balance of power in international affairs.

Hitherto India, which also shares a border with Bhutan and the two countries with the largest populations in the world are at one and the same time competitors and partners. International relations always has this dual character and is the reason why the world is always on the move as countries enjoy periods of harmony and development and also periods of disagreement and strife.

Bhutan may be relatively small in the great scheme of world change but it does nestle between the two giants of Asia in the Himalayas and after a long period of Indian dominance it is inevitable that there will be tensions as China obtains a position in world affairs commensurate with its size and growth.

China and India have had border episodes – some quite recently – of confrontation with casualties, relatively small but a matter of national honour. They also have issues of important agreement in world forums. China is a late arrival on the international scene. The turbulence of the Cultural Revolution is in the past and the focus has been on stability, growth and increasing prosperity. That is the backdrop and the setting for rivalry with India as China reaches out to Bhutan and seeks a long term economic relationship. There is rivalry and competition with Europe, the US, Australia and Japan and other areas of international focus – as we write the focus is now on the Seychelles. China does make an impact – some countries reach out to China and only a few dismiss the opportunity – eg Lithuania. But the growth of China-Bhutan relations is a model for burgeoning links between China and many other countries – especially within the Global South. Change is permanent. Stability is temporary.

—————————————————–

#2 GERMANY’S CHANCELLOR SCHOLZ VISITS CHINA

SOUTH CHINA MORNING POST

Chancellor Scholz visited China last week with the focus on economic re-engagement with Beijing. With German industrialists in tow and flanked by three cabinet ministers Scholz met with President Xi Jinping in Beijing and Xi, in turn will travel to Paris to meet French President Emmanuel Macron, according to diplomats there, capping a series of events and festivities to celebrate 60 years of diplomatic relations. The talks are expected to focus on trade.

“The diplomatic ballet [CHINA AND GERMANY] follows overtures by Beijing. In November, it allowed nationals from the European Union’s five biggest economies to travel visa-free to China, a privilege it has since extended to an additional six European nations—but not the U.S. In January, China reauthorized Irish beef imports, suspended last year on health grounds, and lifted a 2018 ban on Belgian pork.

This marks an inflection point. In just a few months, the EU has launched four investigations into China’s subsidizing of its train, wind turbine, solar panel and EV manufacturers in an effort to curb a flood of cheap Chinese imports. The EU is also pushing European companies to reduce their reliance on certain raw materials from China.

European governments have also largely heeded Washington’s calls to cut China off from advanced chip-making technologies. Germany, China’s biggest European trade partner, unveiled its first China strategy paper last July, calling China a partner and competitor but also a systemic rival and pledging to reduce Germany’s exposure to the Asian giant.

German companies have complained about increasing competition from Chinese rivals in sectors—from luxury autos to advanced industrial machines—that used to be Western preserves. Having largely weathered China’s rise to dominate consumer-goods manufacturing, German high-end engineering companies are being increasingly undercut by Chinese rivals, both in and outside China.

“Brussels is moving aggressively against China,” said Noah Barkin, a Europe-China analyst at Rhodium Group, an independent research group. “But some big European countries like Germany are more preoccupied with Ukraine and Trump…This raises questions about how forcefully they are going to push back against China.”

The threats have led some to question why they should be following America’s lead while China represents a more distant threat—and a bigger economic opportunity—for Europe than Russia.

“We are a manufacturing, export-oriented nation. Our wealth depends on access to international markets,” said Bernd Westphal, a lawmaker for Scholz’s Social Democratic Party who sits on the parliament’s economic policy committee.

Ding Chun, director of the Centre for European Studies at Shanghai-based Fudan University, said the stakes in the event of a Trump electoral victory were high for Europe, given that the U.S. is both a trade partner and the region’s security guarantor. Likewise, Chinese analysts said there was more potential for compromise and cooperation between Europe and China, which are economic competitors, than between China and the U.S., which are increasingly geopolitical rivals.

After Scholz’s election in 2021, Germany adopted a tough-on-China approach, cutting state guarantees for German investments there, intensifying export controls and blocking several prominent Chinese acquisitions of German companies.

Among the myriad products made by Trumpf, a private German engineering company with a large presence in the U.S. and China, are lasers essential for making high-end semiconductors. Berlin doesn’t allow those to be sold to China, but last year, the company’s CEO lashed out at the German government, saying it was slow-walking export permits for a range of innocuous products.

Chinese analysts said Beijing will use Scholz’s visit to defuse growing trade tensions with Europe and ask Berlin to help dilute anti-subsidy investigations launched by the EU in recent months. Germany is sceptical about EU plans to place tariffs on Chinese electric vehicles because German car manufacturers, which have a strong presence in China, fear retaliatory measures.

“We don’t want to reduce trade with China. We want to increase trade with China while at the same time derisking and diversifying,” said a senior German government official

Europe is struggling to adjust to the fact that it now finds itself competing against China in fields it used to dominate, said Wang Yiwei, the director of European Union studies at Renmin University of China in Beijing. “People will feel unsettled. It’s a transition process, it’ll take time for everyone to get accustomed to it.”

While Europe-China trade contracted last year, Europe’s and Germany’s trade deficits have ballooned, reflecting China’s rise up the value chain. At the same time, European companies are increasingly producing inside China. New German direct investments in China reached a record in 2022, according to data compiled by Rhodium Group.

Wang said Chinese companies were willing to mirror such a “local-for-local” strategy in Europe by building local manufacturing facilities for batteries and wind turbines to create jobs and serve the European market, which could assuage European concerns about cheap imports.

The bigger worry in Europe, however, is manufacturers’ reliance on Chinese chemicals, raw materials and parts, some of which are hard or expensive to source elsewhere.

Jürgen Matthes, head of international economic policy at the German Economic Institute, a think tank, said trade data showed that German companies had made little progress in reducing these dependencies over the past two years.

“There is more inertia in this area than the government had hoped,” he said. “Whether substituting these products just takes a long time, or whether some businesses are just not interested, it’s hard to tell.”

Europe and China remain so intertwined that a sudden decoupling between the two on par with the Russia-Europe breakup of 2022 would cause the German economy to contract by 5%, a shock comparable to that of the Covid pandemic and the global financial crisis, according to a December study by the Kiel Institute.

The dependency isn’t one-sided, said Trumpf’s Mayer, noting that China remains dependent on a number of products from Western manufacturers. This means both “should find ways to work with each other in mutual respect,” he said, “without being naive, of course.”

GRAHAM PERRY COMMENTS;-

The reality is that Europe is caught up in a big contradiction with China on trade and international political issues. Let’s start at the beginning. China is a big market – very big and it offers big opportunities to German business. German business does not want to miss out. World markets are competitive and hard work is required to enter into mutually beneficial long term contractual commitments. Big Business is committed to growth, development, and profitability, and senior business executives with an eye on their share price and the profit figure in the bottom right hand corner of their summary paper want more, not less, than China.

The business sector is more focused and single minded than Government, politicians and EU diplomats. This trio have a different set of pressures and priorities and look to Washington, NATO, the IMF and the World Bank who view matters in a geo-political perspective which is dominated by the US-led view that China is more foe than friend.

There is also a noticeable difference of outlook between the EU on the one hand and the individual members of the EU on the other hand. Industrialists accompany Government Leaders to China – and for Germany, read France and you have the two leading powers in Europe – and the Industrialists are the ones driving trade and investment. Brussels drives compliance and politics and has a different set of priorities from the individual countries.

On occasions there will be convergence between the EU leaders and the EU Country Leaders but as the EU tries to apply pressure to China on solar panels, wind turbines and competitively priced electric vehicles with talk of sanctions and tariffs we can expect a tug of war between the geo-political aspirations of Brussels and the combative growth seeking industrialists in France and Germany. “De-risking” and “de-coupling” and following the US line that China is a “systemic threat” will have two consequences; it will challenge the business aspirations of European industrialists to do more. It will also offer China the opportunity to take advantage of tensions between Paris/Berlin and Brussels.

—————————————

#3 CHINA’S TROUBLED PROPERTY SECTOR

SOUTH CHINA MORNING POST

“Vice-Premier He Lifeng urged on-time delivery of properties and financing support for developers at a meeting in central China over the weekend, rallying efforts to revive a sector critical for this year’s economic growth target and financial stability.

China’s property sector once contributed about a quarter of the national economic output, but it has yet to bottom-out in terms of investment and sales, while market confidence remains weak.

“We must understand the property sector is critical,” the vice-premier told local officials, developers and bankers in Zhengzhou, Henan province, during the two-day inspection tour.

“There must be dedicated funding coordination mechanisms to expeditiously loan to all the projects that meet the ‘whitelist’ requirements for timely completion and delivery.”

China’s so-called whitelist was launched by the housing ministry at the start of the year, with provincial governments asked to recommend to banks local residential projects that are deemed financially sound and fit for further loan support.

He also vowed to uphold the rights of homebuyers to stabilise expectations and the development of the sector, ordering stricter scrutiny of loans and presale accounts that are supervised by the government to prevent misappropriation, according to the official Xinhua News Agency.

Zhengzhou is among the Chinese cities grappling with a large number of abandoned or stalled residential projects, with homebuyers seeking either a refund of their down payment or access to their new homes.

While urging for more developers to be added to the government’s whitelist, He also requested targeted solutions for projects that have not yet qualified.

More funding to ensure delivery of new homes also matters to social stability and helping people to spend more

“[Beijing has to] ensure that, when other key sectors like exports are already recovering this year, the overall economic development trend should not be held back by prolonged property sector distress,” said Li Xuenan, a finance professor at the Cheung Kong Graduate School of Business.

GRAHAM PERRY COMMENTS;-

This Column has long held to the view that China is experiencing serious problems with the consequences of its debt overhang flowing from the substantial indebtedness of its property sector. It is a big problem reflected in the use of the term “social stability”. There are many unhappy would-be apartment purchasers who must be feeling quite disillusioned to have advanced hard-earned funds to buy accommodation which has not been completed.

The immediate goal for Government is to address the problem and to discourage the losers from taking their protests onto the streets. The long term goal will be two fold – to recover stability and to reach conclusions about what went wrong. This is the approach adopted in relation to the Cultural Revolution – what needs to be done to repair the problems and win back the support of the people, and then to assess how it was able to develop into such a setback.

The leadership in China are well aware of the property sector failure and the leadership will be active and prominent in an attempt to reassure the people that their faith in the system can be maintained. China is less worried about the inevitable gloating that the West will indulge in. Their concern is the people and their confidence in their leaders. China will come through this period. It has faced and overcome bigger tests. The time for the “What Went Wrong” enquiry will then follow. Those people who follow China will be familiar with the Chinese approach to set backs and subsequent adjustments. They will know that there will be no national enquiry or public commission. China washes its dirty linen in private, not in public. But its investigation will be thorough and far-reaching.

GRAHAM PERRY